Energy Storage

Brian Cashion

Energy Storage

Accure Battery Intelligence

Energy Storage

Jim Brown

Consumer Energy Alliance (CEA), the leading energy and environmental advocate for families and businesses, released the following statement upon the signing of HB 1645 regarding energy resources.

Kevin Doyle, CEA's Florida Executive Director said, "On behalf of CEA and all of our nearly 400-member companies, thank you to Governor DeSantis and to lead sponsors, Representative Bobby Payne and Senator Jay Collins, for moving this important legislation forward into law.”

"Reliable and affordable energy is vital for Florida’s families and businesses and crucial for our health, safety, and welfare. Diversification of Florida’s fuel supply is a necessary measure in advancing the reliability and sustainability of energy for Floridians.”

"Through comprehensive reforms, HB 1645 promotes policies that ensure Florida’s energy future is secure. This legislation promotes the development of natural gas and renewable energy resources and prioritizes energy production and infrastructure improvements."

HB 1645 allows our utility companies to build redundancy into their operations, offers customers more energy choices and provides Floridians with greater reliability during extreme weather and peak demand events. Florida’s energy rates are much lower than the national standard due to our diverse portfolio, and HB 1645 aims to promote and maintain the benefits Florida’s energy innovation has provided thus far.

Doyle continued, "We appreciate your support of HB 1645 and we thanks Representative Bobby Payne and Senator Jay Collins for sponsoring this legislation during the legislative session. With your signature of this important piece of legislation, our residents in Florida can continue to have access to reliable, affordable, and abundant energy sources."

Federal, state, and industry leaders on Day One of the 2024 Pacific Offshore Wind Summit joined in encouraging California to advance its plans to deploy 25 gigawatts (GW) from offshore wind by 2045, as the state sets a course to be a global leader on floating offshore wind power. Speakers at the Summit, hosted by Offshore Wind California (OWC), urged the state to move expeditiously on essential next steps to develop offshore wind at scale – including investing in transmission and ports, procuring at scale, setting a permitting roadmap, engaging key stakeholders, building a supply chain and workforce training, and defining more lease areas to reach the state's goals.

The California Energy Commission (CEC) is finalizing the state's draft AB 525 Strategic Plan, which was released in January and outlines California's next steps to responsibly develop offshore wind and achieve its planning goals for up to 5 GW by 2030 and 25 GW by 2045. Last fall, Governor Newsom signed AB 1373 enabling the state to procure offshore wind at scale. Last December, California also joined the Global Offshore Wind Alliance and has now signed agreements with Norway, Denmark, Japan, China, and Scotland to advance deployment of floating offshore wind.

"25 GW of offshore wind is a landmark goal. We're all in on building this, bringing it to fruition, and doing it the right way," said David Hochschild, Chair, CEC, of the floating technology California is moving ahead to deploy 20 miles offshore. "That means a very inclusive process, it means a lot of dialogue, and it means really trying to do it in a way that supports and uplifts communities. We see offshore wind playing a fundamental role not just in our climate strategy but our economic future as well. We're going to be adopting, if all goes well, California's strategic plan for offshore wind at our Commission meeting next month," he said to 700+ federal and state officials, industry leaders, and stakeholders attending the Summit.

"Now is the time to address climate change by supporting a thriving domestic offshore wind industry," said Liz Klein, Director, Bureau of Ocean Energy Management (BOEM). "At BOEM, we are proud of the strong partnership we've built with California. We share your enthusiasm over the state's ambitious goals to reach 5 GW by 2030 and 25 GW by 2045. We held our first California lease sale in 2022. We're excited to continue our close partnership as you pursue the state's vision to be a leader in offshore wind, particularly floating offshore wind."

In April, the Biden Administration announced its plan in the next five years for up to 12 rounds of offshore wind leasing, including California, to meet its national goals for 30 GW of offshore wind by 2030, 15 GW of floating wind by 2035, and a path to 110 GW by 2050. BOEM held its first federal auction for California offshore wind in December 2022, identifying five leaseholders to deploy an initial 7 to 10 GW off the state's Central and North Coast, according to industry estimates.

"In a California for all, we are creating offshore wind for all," said Jana Ganion, Senior Advisor, Offshore Wind, Office of Gov. Gavin Newsom. "Offshore wind, if developed responsibly, is a cleaner energy solution at the scale we need to combat the climate emergency. Offshore wind also has the capacity factor and attributes to improve electric reliability and complement other clean energy resources such as solar. And because offshore wind requires supporting industry – ports, transmission, ecosystem management, supply chains – it has considerable promise to create high-quality jobs."

"We are going to go big on offshore wind energy. We're going to go big on our climate goals. And we're going to go big on support for our local communities," said Assemblymember Dawn Addis, (D-San Luis Obispo) California State Assembly. "It's important that as we move offshore wind development forward we're founded in science and we duly engage local communities," said Addis who Chairs the Assembly Select Committee on Offshore Wind and authors legislation to ensure offshore wind co-exists with ocean life and habitat and also to create a capacity-building fund for local communities.

"California is well positioned to be a global leader of floating offshore wind," said Ruth Perry, Board Chair, OWC, a trade group of offshore wind developers and technology firms. "To make it a reality, Offshore Wind California is encouraged by the state's AB 525 Strategic Plan. We urge California to move ahead on the key next steps to responsibly develop offshore wind – which generates power night-and-day – and help the state meet its climate, clean-energy, and grid-reliability goals."

The National Renewable Energy Laboratory estimates California's offshore wind potential at 200 GW, with more than 25 GW in BOEM's two lease areas and the waters off the state's North Coast. Deeper West Coast waters require floating technologies already deployed in other world markets. Reports show that developing 25 GW of Californiaoffshore wind can support thousands of jobs, supply up to 15-20% of the state's planned new clean energy, save ratepayers billions of dollars, drive economies of scale, and generate enough competitively priced electricity to power up to 25 million homes.

Offshore Wind California's more than 40 members include Burns & McDonnell, Crowley Wind Services, Fugro, General Dynamics NASSCO, Pacific Ocean Energy Trust, PG&E, Port of Long Beach, Shell, SSE Renewables, WSP, Vestas, and XODUS.

Offshore Wind California | www.offshorewindca.org

Asahi Kasei announced that it will construct its previously announced integrated lithium-ion battery (LIB) separator plant in Port Colborne, which is in the Niagara region of Ontario, Canada. The new manufacturing facility will operate as Asahi Kasei Battery Separator Canada and is expected to create highly skilled, good paying jobs in manufacturing and construction. The start of commercial production is currently slated for 2027.

Koshiro Kudo, President & Representative Director of Asahi Kasei Corporation, who attended for the location announcement event, stated, “As demand for electric vehicles – and the lithium-ion batteries that power them – continues to rise, we are eager to bring the first Hipore™ wet-process lithium-ion separator manufacturing facility to Canada. Backed by the abundant renewable resources, skilled talent and strong local community support here in Port Colborne, we will be able to better serve our partners in the region as well as the broader North American automotive market from this facility.”

The Hipore wet-process separators to be produced at the Port Colborne facility are among the most highly engineered and critical components of LIBs used in EVs and other energy storage applications.

On April 25, 2024, Asahi Kasei announced an initial investment of approximately 180 billion JPY (CAD$ 1.56 billion) to install approximately 700 million square meters of annual Hipore separator capacity at this new Canadian facility.

Asahi Kasei will receive support for the project from the provincial government of Ontario, through its investment attraction agency, Invest Ontario, and will benefit from the federal government’s new Clean Technology Manufacturing Investment Tax Credit (ITC).

Asahi Kasei Group | www.asahi-kasei.com

Clean Power Alliance (CPA) has launched its Energized Communities Program to help CPA’s partner communities reduce greenhouse gas emissions (GHGs) by providing financial and technical support for vehicle and building electrification. The program is designed to promote sustainability in the 35 communities CPA serves.

CPA is making $10 million in funding available over a three-year period to its partner communities to implement available pathways in the program.

“Communities have been asking for ways to help reduce greenhouse gases and Energized Communities is a program created to respond to that need,” said CPA Board Chair Deborah Klein Lopez. “Providing tangible pathways for cities to decarbonize is an important step forward to reach sustainability goals and is another example of how CPA partners with the communities it serves.”

The program includes two ways to participate: 1) Pathways to Electrification, which streamlines implementation of electrification measures at municipal facilities and 2) an Innovation Grant, which will launch later this year, to support creative decarbonization projects within CPA’s service area. Both program offerings will provide up to $250,000 per project.

Pathways to Electrification will assist participating communities in planning and funding building electrification, EV charging infrastructure for community use, and the transition of municipal fleets to electric vehicles. Communities can select one of these three projects and will receive direct funding and planning assistance to implement electrification measures. CPA is starting this effort with support for fleet and building electrification projects.

Pathways to Electrification aligns with the California Air Resources Board’s 2022 Scoping Plan for Achieving Carbon Neutrality, which requires that fleets comply with emission reductions for mobile vehicles and phase-in the use and manufacturing of zero-emission vehicles (ZEVs) by 2036. The plan aims to reduce GHGs by 85 percent below 1990 levels no later than 2045.

To execute Energized Communities, CPA has contracted with energy engineering firm Lincus Inc. and clean energy consulting firm Optony Inc. for their expertise in decarbonization planning and implementation.

Converting gas-powered transportation fleets will benefit municipalities with a reduction in harmful GHG emissions and cost savings on fuel and maintenance. According to Optony Inc. who will lead the electric fleet transition project, small municipal fleets of fewer than 100 vehicles that have gone through similar fleet electrification efforts have the potential to reduce fuel consumption by 50,000 gallons and avoid approximately 770,000 pounds of emissions each year.

Similarly, communities that participate in the building electrification assistance project can experience a reduction in GHG emissions by converting their gas-powered equipment to electric alternatives and realize the added benefits of natural gas and maintenance cost savings.

Based on electrification work completed by Lincus Inc., who will lead the building electrification assistance project, municipalities that have electrified their water heating systems have seen a reduction of more than 8,000 pounds in emissions annually. This environmental benefit is equivalent to planting 60 trees or driving 9,500 fewer car miles. Results will vary by facility size and equipment selected for installation, and CPA anticipates successful outcomes for the projects implemented through the Energized Communities program.

“Clean Power Alliance is committed to the wellbeing of our communities and providing opportunities that accelerate sustainability efforts,” said CPA CEO Ted Bardacke. “Our strategic investments in customer programs and initiatives that expand clean energy infrastructure will create lasting benefits across Southern California.”

To learn more about CPA’s Energized Communities Program, visit cleanpoweralliance.org/energized-communities.

Clean Power Alliance | https://cleanpoweralliance.org/

Lincus | lincusenergy.com

Optony | optonyusa.com

On December 15, 2022, the California Public Utilities Commission passed an overhaul of the net metering program for the state’s investor-owned utilities. The changes replaced the long-standing net energy metering (NEM) tariffs with a net billing tariff (NBT) structure—colloquially known as “NEM 3.0”—which significantly reduces the compensation for behind-the-meter solar photovoltaic (PV) systems. The NEM tariffs remained open for new interconnection applications until April 15, 2023, but after that date, all new interconnection applications were submitted under NBT. Now, one year later, we have an opportunity to evaluate how the California solar market has evolved under this new compensation regime.

As a precursor to its annual Tracking the Sun report, Berkeley Lab has released a short technical brief describing key trends in the California residential solar market since the roll-out of the new NBT structure. The purpose of this analysis is to provide empirical insights into how the market has evolved over the past year, confirming some expectations while also revealing several striking surprises.

Key trends include the following:

To be sure, not all of the trends described above can be attributed entirely to NBT, as other important factors have also been at play, and this brief data summary does not attempt to parse out the effects of the many drivers. But at least on first glance, NBT does appear to have already had significant impacts on the California residential PV market. These impacts and others will no doubt come into sharper focus over the next year, once the NEM backlog is fully cleared and a “new normal” under NBT sets in.

For further details, please see the full technical brief, One Year In: Tracking the Impacts of NEM 3.0 on California’s Residential Solar Market, available here: https://emp.lbl.gov/publications/one-year-tracking-impacts-nem-30.

Berkeley Lab | emp.lbl.gov

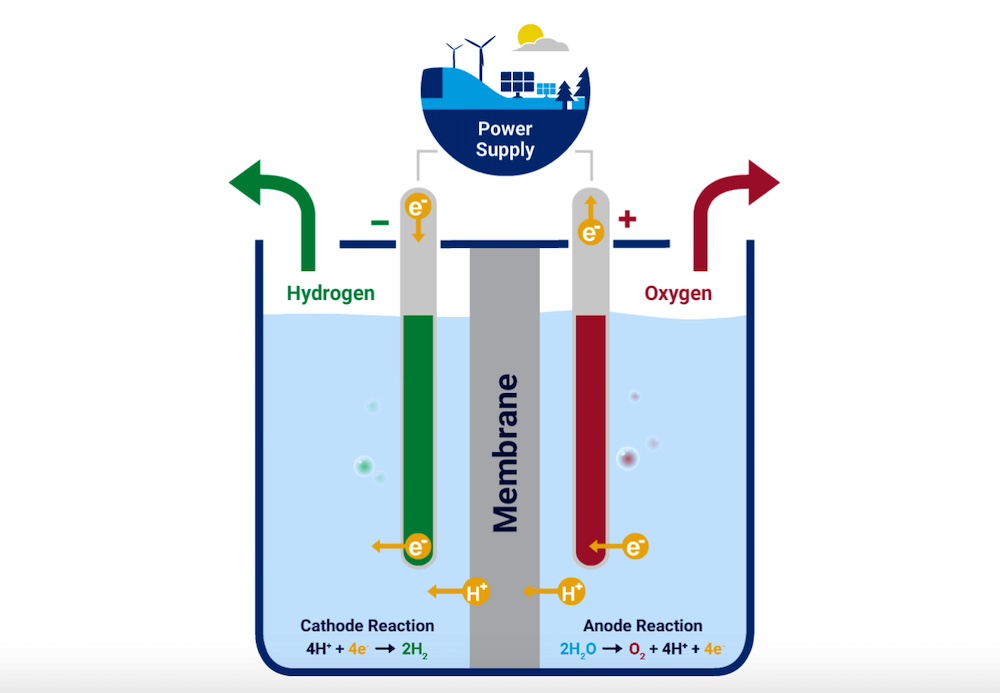

Green hydrogen, a clean fuel with applications for the industrial, power, and transportation sectors, has emerged as a key focal point of the global energy transition and is driving opportunities for companies across the water industry, according to a new report from Bluefield Research, The Hydrogen Economy: Water Demand, Management Strategies, and Global Forecasts, 2024–2030.

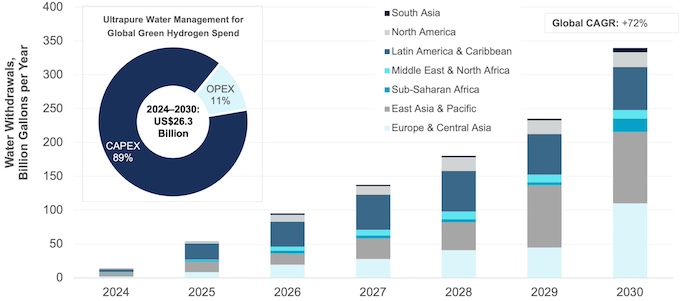

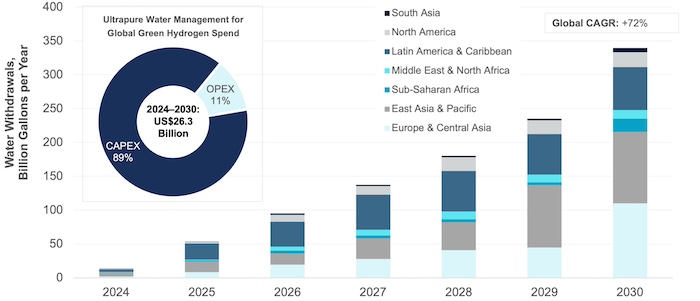

Through 2030, US$26.3 billion will be spent on water management (i.e., CAPEX, OPEX) for hydrogen applications, according to Bluefield’s global forecasts. “The scale and success of the hydrogen market also depends on the sometimes-overlooked availability of water supplies,” says Bluefield President and CEO Reese Tisdale. “We would certainly expect to see increasing investment in water reuse (i.e., reclaimed wastewater), brackish and seawater desalination, and municipal utility infrastructure to meet scaling water demand, globally.”

The nascent hydrogen sector is experiencing unprecedented momentum shaped by new policies, financial incentives, and project developer interests. To date, 30 countries have developed hydrogen strategies and roadmaps with almost 2,000 projects announced on every continent, according to Bluefield’s report. “Whether it be the Inflation Reduction Act in the U.S., the EU’s regulatory framework for achieving its green hydrogen production goal, China’s five-year plan highlighting green development, Japan’s investment in fuel cells, or Australia’s goal to be a renewable energy exporter, hydrogen investment and interest is at an all-time high.” says Tisdale.

Exhibit: Planned Green Hydrogen Global Water Withdrawals by Region, 2024–2030

Note: ‘Undisclosed’ hydrogen colors not included in outlook

Source: Bluefield Research

Highly treated ultrapure water is the critical input for producing green hydrogen that can serve a wide range of applications including power (i.e., energy storage), transportation (i.e., shipping, truck fleets), and industrial inputs (e.g., fertilizer, steel). For this reason, water resource availability is a crucial issue in hydrogen production. In fact, 63% percent of the hydrogen project development is taking place in regions of water stress.

“If completed, the total number of projects would require 598 billion gallons of water per year in 2030. That is enough water to serve the population of New York City for a year,” according to Tisdale. The estimated water volume demand for the current green hydrogen project pipeline is forecasted to scale at a 72% compound annual growth rate (CAGR) from 2024 through 2030. This number could climb over time as the green hydrogen project pipeline builds in the U.S. For all of this to happen, hydrogen electrolyzer technology suppliers must advance in scale and costs must decline for the sector to take off.

The success of hydrogen will hinge largely on the success of leading renewable and energy players like Iberdrola, NextEra, Air Liquide, Chevron, and Shell. In their wake, leading water solutions providers, like Ecolab, Veolia, Xylem, and Acciona, among others, stand to benefit from the demand for more advanced water treatment, reuse, and desalination. Similarly, a host of engineering and construction companies, oftentimes referred to as the gatekeepers to water infrastructure development, are already playing key roles.

“Green hydrogen cannot exist without water, and there are so many implications for the water sector if green hydrogen takes off as a fuel of choice,” says Tisdale. “The key is for the industry to seize on this momentum and proactively consider the opportunities for more advanced water management.”

Bluefield’s Insight Report offers an in-depth analysis of the potential implications through the growing hydrogen economy on global water demand, management strategies, and market forecasts. Access this report here. Bluefield clients also have access to the Global Hydrogen Forecast dashboard on Bluefield’s Data Navigator platform. Not a Bluefield client? This report is available for purchase using the same link above.

Bluefield Research | https://www.bluefieldresearch.com/

EverWind Fuels ("EverWind"), a leading North American developer of a green fuels hub centered in Atlantic Canada, was joined by officials from the Province of Nova Scotia in announcing a partnership with the Port of Rotterdam to advance the green hydrogen supply chain.

Port of Rotterdam is Europe’s largest seaport, and is the manager, operator and developer of the Rotterdam port and industrial areas. The Port of Rotterdam is an important energy port for Northwest Europe and a key distribution channel to Germany’s industrial heartland, the Ruhr area.

With this partnership, EverWind’s green hydrogen production from its projects in Atlantic Canada will support Port of Rotterdam’s establishment of an international hub for hydrogen production, import, application, and transport to other countries in Northwest Europe. Three times as much energy is now transported via Rotterdam than is consumed in the whole of the Netherlands, with expectations to import eighteen million tonnes of hydrogen via Rotterdam in 2050. There are several advanced developments in the Port of Rotterdam to receive green ammonia as early as 2026, with ammonia and hydrogen users within the Port of Rotterdam complex and connected to its various green fuels corridors.

EverWind recently completed front-end engineering design (FEED), which included over 110,000 hours of engineering, marking a major milestone in the development of its project and represents the first announced completion of FEED for a large-scale green hydrogen and green ammonia production facility in North America.

“We are excited for EverWind to support the establishment of Port of Rotterdam as the leading port for sustainable energy. Rotterdam has been a trusted hub for decades – it is now ready and able to make the switch to hydrogen, and we are excited for EverWind’s green hydrogen and green ammonia production to be among the first volumes from North America to land in Europe.”

Boudewijn Siemons,

CEO of Port of Rotterdam Authority

“Nova Scotia is poised to be a world leader in the production of green hydrogen. Our Government is excited to host EverWind’s Point Tupper project which will bring green jobs and a clean, sustainable future for Nova Scotians. Green hydrogen leadership will help us and our global partners develop our green economies and fight climate change.”

The Honourable Tim Houston,

Premier of Nova Scotia

“Establishing successful green hydrogen projects requires establishing a global supply chain, and we are excited to work with Port of Rotterdam, Europe’s largest seaport to support this endeavour. We’re confident that our projects in Atlantic Canada will produce the greenest, most cost-competitive green hydrogen in North America to decarbonize carbon-intensive processes domestically and abroad.”

Trent Vichie

Founder and CEO, EverWind Fuels

EverWind Fuels | https://everwindfuels.com/

Alternative Energies Jun 26, 2023

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties. The money is there — so where are the projects? A cleaner and more secure energy ....

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

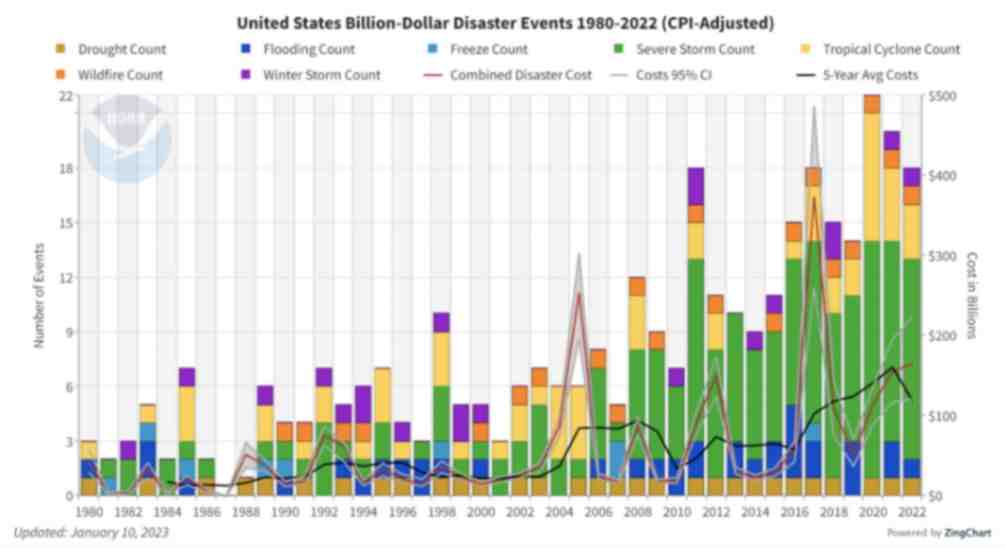

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

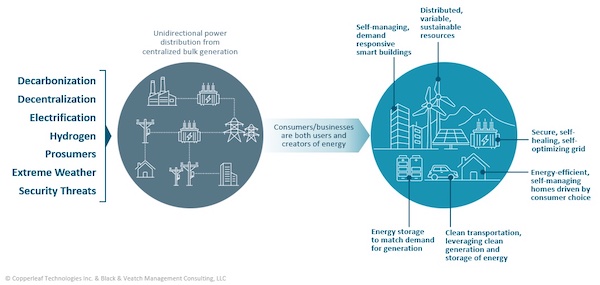

Grid modernization is having a profound impact on the nature and regulation of North American utilities. It represents a significant change to the way energy is managed, distributed, and used—today and in the future. As Environmental, Social, and Governance (ESG) targets become increasingly important to energy investors and regulators, how can organizations transform their Asset Investment Planning (AIP) processes to overcome challenges and take advantage of emerging opportunities?

Grid modernization

The energy transition refers to the global energy sector’s shift from fossil-based systems of energy production and consumption to renewable energy sources like wind and solar, as well as long-term energy storage such as batteries. The increasing penetration of renewable energy into the energy supply mix and the onset of electrification and improvements in energy storage are key drivers of the energy transition.

Grid modernization is a subset of the energy transition, and refers to changes needed in the electric transmission and distribution (T&D) systems to accommodate these rapid and innovative technological changes. Grid modernization often necessitates the increased application of sensors, computers, and communications to increase the intelligence of the grid and its ability to respond swiftly to external factors. The main goals of the grid are to provide the capacity, reliability, and flexibility needed to adapt to a whole range of new technologies (in the drive to net zero), while maintaining a comparable level of service and cost to the end customer.

Grid modernization projects are driven by both climate resilience through hardening of assets and changes to the T&D network to accommodate climate mitigation strategies. There are 3 broad categories for these types of projects:

Grid modernization is accelerating due to multiple factors, such as decarbonization, electrification, extreme weather, and security threats.

Valuing innovative projects

The changing demands dictated by grid modernization will require organizations to strike the right balance between cost-effectively managing the current business, while investing appropriately to meet future demands. Organizations are already seeing an increase in both the volume and variety of grid modernization projects. This is leading to increased planning complexity, requiring utilities to demonstrate that they are spending their limited budgets and resources to maximize value and drive their ESG and performance targets.

A value-based approach to investment decision making is key to establishing a common basis to evaluate potential investment opportunities and meet the challenges of grid modernization. The key to achieving your organization’s grid modernization goals is building a multi-year plan that breaks the work into executable chunks. This ensures adequate funding and resources are available to carry out the plan in the short-term, resulting in incremental progress toward longer-term objectives.

With a value-based decision-making approach, organizations can ensure they are making the right grid modernization investments—and justify their plans to internal and external stakeholders.

Align decisions with strategic objectives

Business leaders must develop frameworks that quantify the financial and non-financial benefits of all proposed investments on a common scale and understand how projects will contribute to their short- and long-term grid modernization initiatives and broader energy transition goals. A value framework also creates a clear line of sight from planned investments to regulatory and corporate targets, allowing organizations to provide transparency into the decision-making methodology—and demonstrate the benefits of their plans to regulators, stakeholders, and customers:

Russ is a Director of Product Management, Decision Analytics at Copperleaf. He is an innovative leader with over 20 years of comprehensive business and technical experience in high-tech product development organizations. Russ holds a B.A.Sc. in Mechanical Engineering from the University of British Columbia and a Management of Technology MBA from Simon Fraser University.

Russ is a Director of Product Management, Decision Analytics at Copperleaf. He is an innovative leader with over 20 years of comprehensive business and technical experience in high-tech product development organizations. Russ holds a B.A.Sc. in Mechanical Engineering from the University of British Columbia and a Management of Technology MBA from Simon Fraser University.

Copperleaf | www.copperleaf.com

What’s underneath the surface of the land that you plan to develop and who owns it? Identifying owners of mineral rights is critical for utility-scale solar energy projects, especially in regions where these rights are legally separable from surfac....

Since the passage of the Inflation Reduction Act nearly two years ago, U.S. solar panel makers navigate a promising market amid production, legal, and investment considerations Nearly two years after U.S. President Joe Biden signed the Inflation R....

The global shift towards clean energy — exemplified by the widespread adoption of solar power — is not only a beacon of hope for a sustainable future, but also comes with heightened expectations for responsible project execution. From the initial....

The impacts of climate change are becoming increasingly more apparent as communities around the world experience extreme weather events. From hurricanes and floods to droughts and wildfires, these types of events can have profound negatives effects o....

When thinking of renewable energy sources, you most likely picture solar panels or massive wind turbines, churning out energy to reduce the strain on electric grids and helping towns and businesses meet lofty sustainability goals. However, when an ex....

The US offshore wind sector has entered 2024 with cautious optimism as the industry shakes off negativity from last year, ready to apply learnings from a challenging 2023 to the year ahead. There are already key projects in the pipeline, including th....

As the world accelerates its transition to renewable energy sources, the deployment of energy storage solutions has surged to meet the demands of this ongoing transformation. Battery Energy Storage System (BESS) capacity is likely to quintuple betwee....

On April 19, 2019, a thermal runaway event took place in a battery energy storage unit (ESS) located within a building in Surprise, Arizona. The ESS was provided with fire detection and fire suppression, which both activated. Approximately five hours....

The summer of 2023 was the hottest in recorded history, hitting the United States with disproportionate force. A climatology report by PBS explained that the terrain in and surrounding the U.S. contributes to powerful competing air masses t....

As industrial operations look for opportunities to decrease their carbon emissions, hydrogen fuel cell vehicles and battery-electric vehicles have emerged as potential solutions. These power options generate zero carbon emissions at the tai....

In the last five years, North America has experienced a significant increase in severe weather events that have impacted power grids. In Canada, Alberta's electric system operator issued 17 provincial grid alerts since 2021, due to extreme weather co....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....